Government Business Loan:- You will always need a consistent cash flow, regardless of whether you want to bootstrap a startup or grow your current business. This is where business loans or corporate loans come into play, and a business loan can assist you in obtaining the necessary capital for your company. Considering the recent spike in fintech in the nation, many private lenders are eager to provide business loans, but the Indian government also offers a variety of lending programs to business owners through its various agencies. Government agencies provide business owners with loans at competitive interest rates and frequently even without any type of collateral.

Top 7 Government Business Loan Scheme

Some of the top Government Business Loans offered by the Indian Government are as follows:

- MSME Loan Scheme

- MUDRA Loan

- Credit Guarantee Fund Scheme

- National Small Industries Corporation Subsidy

- SIDBI Loan

- Credit Link Capital Subsidy Scheme

- Udyogini

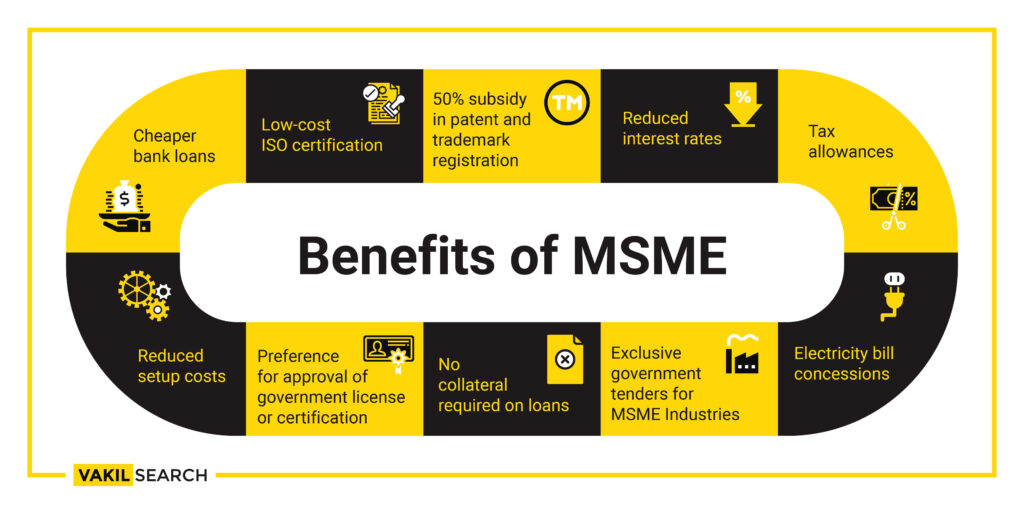

MSME Loan Scheme

Image Credit : Google

The Government of India started the MSME Business Loan Scheme to concentrate on the working capital needs of businesses in the MSME sector. Under the MSME scheme, any business new or old can apply for loans for financial support of up to Rs. 1 crore. While the approval or rejection of a loan application is given within the first 59 minutes of the application, the loan processing takes 8–12 days to complete. The MSME Loan Scheme’s biggest feature is that you can acquire a loan at 8% ROI, which makes loan payments simpler. For loans obtained through the MSME Loan Scheme, women entrepreneurs are given a 3% preference. Additionally, the loan approval process is also generally simpler for women business owners.

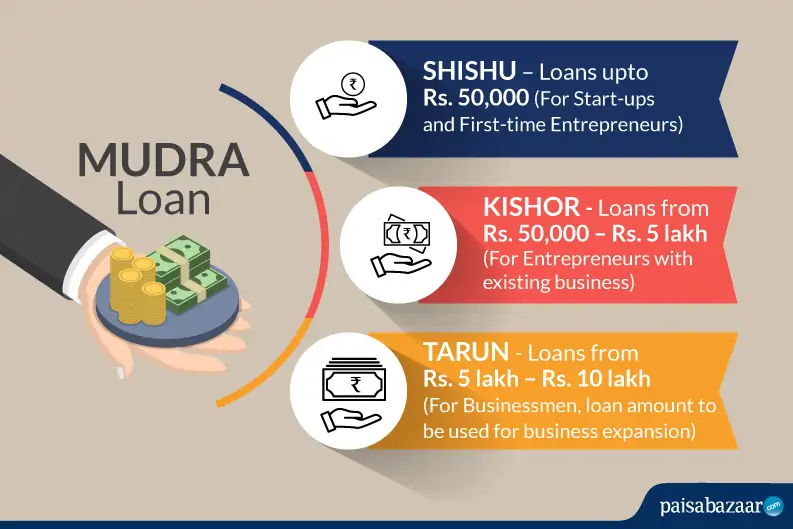

MUDRA Loan

Image Credit : Google

The Micro-Units Development and Refinance Agency organization, which was founded by the government of India to provide money to units of micro-business, approves the MUDRA loans. Small enterprises and start-ups can receive financial support in the form of low-cost credit through the Micro Units Development and Refinance Agency (MUDRA) funding program. MUDRA loans are primarily given to micro or small firms engaged in manufacturing, trade, or providing services. Banks in the public and private sectors, cooperative societies, local banks, scheduled commercial banks, and rural areas all accept applications for MUDRA Loans. A commercial entity has three options for applying to the MUDRA loan program. The MUDRA loans fall into the following categories:

Credit Guarantee Fund Scheme

Image Credit : Google

The Indian government has introduced a Credit Guarantee Scheme that enables funding for enterprises that are part of the MSME sector through unsecured loans. Both new and existing businesses may be offered loans under the program. The Ministry of MSMEs and Small Industries established the Credit Guarantee Fund Trust as a trust to implement the CGFMSE program. Working capital loans of up to Rs. 200 lakhs may be made available under this program, with preference given to qualified women business owners.

The organizations engaged in manufacturing, such as retailers, educational institutions, self-help organizations, and training facilities. Additionally, companies in the service sector are also eligible to apply for funding under this loan program.

National Small Industries Corporation Subsidy

Image Credit : Google

The NSIC is an ISO-certified government enterprise that falls within the MSMEs category. One of its main responsibilities is to support the expansion of MSMEs across the nation by offering services in the areas of financing, technology, market, and other services. The advantage of this program is that it gives small businesses free access to bid opportunities, and MSMEs do not have to pay security deposits to use this program’s financial aid options. The NSIC has launched two programs to encourage the expansion of MSMEs, which are as follows:

- Marketing Support Scheme: The Marketing Support Scheme helps any business flourish by coming up with plans like Consortia and Tender Marketing. A program like this is essential since MSMEs need assistance to expand in the current cutthroat economy.

- Credit Support Scheme: The NSIC offers finance to MSMEs through bank syndication for raw material procurement, marketing activities, and financing.

SIDBI Loan

Image Credit : Google

In order to meet the funding requirements of businesses in the MSME sector, SIDBI, or the Small Industries Development Bank of India, was established in 1990. SIDBI offers indirect lending programs to NBFCs (Non-Banking Financial Companies) and SFBs (Small Finance Banks) in addition to direct loan programs to MSMEs. The loan term may be up to 10 years, and the loan amount may range from 10 Lakhs to 25 Crores. You can obtain loans up to Rs. 1 crore without putting up any security.

The bank’s different lending programs, such as SIDBI-lending for Purchase of Equipment for Enterprise Development (SPEED), SIDBI Make in India Soft Loan Fund for MSME (SMILE), Smile Equipment Finance (SEF), and others, allow MSMEs to apply for loans. Each loan plan has a different loan tenure, loan amount, and eligibility requirements. Numerous lending institutions now provide special loan products for MSMEs because the number of MSMEs is consistently increasing in India. You can apply for a SME loan for your company at Bajaj Markets, where the interest rates are competitive. You may quickly apply for SME loans through the Bajaj Markets app, and you can even find pre-approved deals there.

Credit Link Capital Subsidy Scheme

Image Credit : Google

By funding technological advancement, this program enables small businesses to upgrade their procedure. The organization’s various processes, including production, marketing, supply chain management, etc., can all be affected by technological advancement. The government hopes to lower the cost of producing goods and services for small and medium-sized businesses through the CLCSS scheme, enabling them to maintain pricing competition in domestic and international markets. The Ministry for Small-Scale Industries is in charge of the program. For enterprises that qualify, the CLCSS provides a 15% up-front capital subsidy. The maximum amount that may be used as a subsidy under the program, however, is capped at Rs. 15 lakhs. This business financing program is open to sole proprietorships, partnership businesses, co-operatives, private limited corporations, and public limited companies.

Udyogini Scheme for Women

Image Credit : Google

A program called Udyogini, which means “women empowerment,” has been started to empower Indian women. The Women Development Corporation, on behalf of the Government of India, launched the Udyogini Scheme for Women Entrepreneurs. The cash provided under this program is given to assist women in obtaining the capital they need to launch a business. Under this program, a loan can only be given up to Rs. 15,00,000. A woman entrepreneur must be between the ages of 18 and 55 to be eligible to apply for this program, and her family’s annual income cannot exceed Rs. 15,00,000.

Women who are physically disabled or widowed have no income restrictions. For a loan to be obtained under this plan, there is no processing charge or requirement for collateral. To be eligible for the loan, women must provide passport-sized photos, birth certificates, Poverty Line Cards, Aadhar Cards, Caste Certificates, passbooks or bank accounts, ration cards, and income documentation. Qualified women can apply for loans for the 88 different types of enterprises listed.

Read also : [Apply Online] Odisha Balaram Yojana 2024 – Benefits & Eligibility, Form PDF